According to the latest dunnhumby Consumer Trends Tracker, Americans believe that food-at-home inflation has hit 22.8 percent, 9.7 points higher than the 13.1 percent annual rate reported by the U.S. Bureau of Labor Statistics.

The perceived rate of food inflation is 5.1 percent higher than the dunnhumby Consumer Pulse report from February, just after Ukraine was invaded. The dunnhumby study also found that the impact of food inflation varies widely by geography and demographics. The CTT is part of The dunnhumby Quarterly, a market analysis of key retail themes, with the second edition being focused on inflation.

“Seven months ago, we first reported on the mismatch between consumer sentiment and reality regarding food inflation. We now we see it’s at the highest point to date, and we are also seeing that consumers are responding by changing their shopping behavior, and perhaps most troublingly, nearly a third are cutting back or completely eliminating some meals,” said Grant Steadman, president for North America at dunnhumby.

“While there are signs in parts of the economy that inflation may be dampening, that has not occurred yet for food. Retailers and manufacturers need to ensure that they are putting their customers first when they are making decisions about how to respond to persistent inflationary cost pressures.”

Key findings from the study:

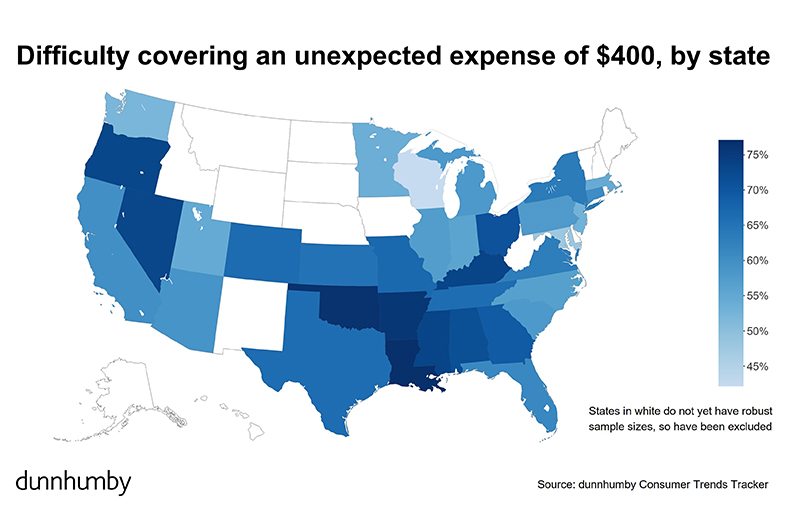

- Sixty-four percent of U.S. consumers report they would have difficulty covering an unexpected expense of $400 or more compared to 60 percent in April-May. The study found a wide range of financial insecurity with a low of 42 percent in Wisconsin, followed by 48 percent in Maryland and 52 percent in Washington, to a high of 77 percent in Louisiana and Oklahoma.

- Fifty-five percent of consumers surveyed report they are not getting enough of the food they want to eat, and 18 percent are not getting enough to eat. In addition, 31 percent of households have skipped or reduced the size of their meals in the last 12 month because there wasn’t enough food, a 5 percent increase since the last CTT survey May-June.

- Seventy-five percent of consumers want retailers to provide consistent prices. Seventy-three percent of households with incomes above $100,000 reported that low base prices are important, an increase of 7 percent. Shopping at stores with low base prices is the most common shopper behavior with 59 percent of those surveyed reporting they do this most of the time.

- Checking prices online before and while shopping is the second most popular customer behavior, with 37 percent of consumers reporting they do this. This behavior is up 6 percent since the first CTT. Rounding out the top three most common customer behaviors are buying in bulk (35 percent) tied with shopping at different stores to find the best value (35 percent).

- Consumers are shifting a significant share of their spending to dollar stores, at the expense of specialty and premium stores. Between October 2021 and July, there’s been approximately a 20 percent increase in people citing additional fees (e.g. delivery and picking fees) as a barrier to buying groceries online.

- Eighty-three percent of respondents are looking for cheaper alternatives to the products they usually buy in at least one category. The top three categories consumers are trading down in are packaged food (53 percent), common household products (52 percent) and frozen food (42 percent).

- The purchase of premium or luxury items are on the rise, particularly in the 35-44 age range. Customers are likely to be forgoing more expensive luxuries, in place of small luxuries available at the grocery store.

The Consumer Trends Tracker was first launched in April and included an online survey of 2,012 consumers, representative of the U.S. grocery shopper nationwide. The most recent wave of the CTT includes an online survey of 2,000 U.S. shoppers that was conducted in July. The study is designed to uncover shopper needs, perceptions and behavior over time, and to complement dunnhumby’s Retailer Preference Index which measures the strength of retailers’ customer value proposition.

For more technology news from The Shelby Report, click here.