The Retail Grocers Association of Greater Kansas City is celebrating a victory in the Kansas Legislature – the reduction and eventual elimination of the state’s food sales tax.

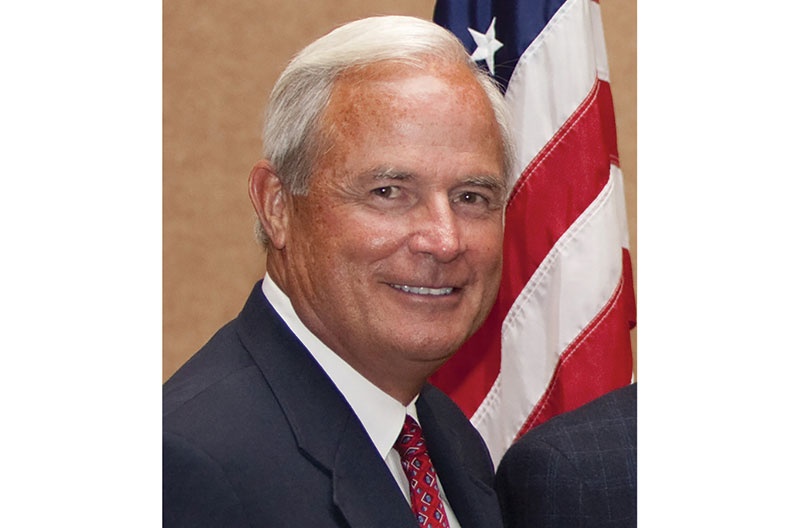

Since 1960, the state has had one of the highest rates in the country. It currently sits at 6.5 percent, according to Jon McCormick, president and CEO of RGA. But on Jan. 1, 2023, that number will start to decline.

Gov. Laura Kelly recently signed the “Axe the Food Tax” bill that will gradually lower the rate over the next three years until it reaches zero. RGA’s lobbyists had hoped to get the tax eliminated immediately.

While the measure is viewed as a victory for the state as a whole, municipalities still have the right to impose their own sales taxes.

“In the state of Kansas, cities and counties have a food sales tax as well. So [the tax rate] could be as high as 10 percent,” McCormick said.

When compared to its neighbors, Kansas’ rate stands out. Nebraska, Colorado and Iowa currently have no such tax, while Missouri is at 1.2 percent and Oklahoma at 4.5 percent.

The difference has had a profound effect on independent grocers in Kansas.

“We’ve lost over 100 stores since 2008 in the state of Kansas and a majority are along the border of Missouri and Nebraska,” McCormick explained. “The majority of stores lost were in the border towns.

“Route 36 is up north in Kansas and it’s only 30 to 45 minutes away from these towns in Nebraska that are thriving. These border towns just aren’t able to maintain [their stores].”

Next up for RGA, officials are turning their attention to a national bipartisan measure introduced Aug. 10 by U.S. Sens. Roger Marshall of Kansas and Dick Durban of Illinois. The “Credit Card Competition Act of 2022” aims to lower the cost of credit card acceptance for grocers. The bill would give grocers the power to route credit card transactions through unaffiliated networks.

“Visa, MasterCard, that whole industry – it’s a duopoly. And they just announced an increase and there’s nowhere for a retailer to go to get a quote … [the bill] would open that up,” McCormick said.

“Now it is time for everyone – I mean everyone – to send a note to your Senators urging them to co-sponsor this bipartisan bill to create competition and help lower card fees,” McCormick wrote in his industry e-newsletter.

Currently, Visa and Mastercard control 77 percent of the U.S. credit card market, followed by American Express and Discover, respectively, according to SEC filings. U.S. merchants paid more than $137.8 billion in fees to accept the cards, McCormick said.

For more information, visit membership.kcchamber.com.