The Feedback Group, a Lake Success, New York-based company that provides actionable stakeholder feedback, has released findings from new national research conducted with more than 1,200 grocery shoppers about their response to food price inflation and their perception of supermarket profitability.

Shoppers Employ Various Strategies to Cope with Food Price Inflation

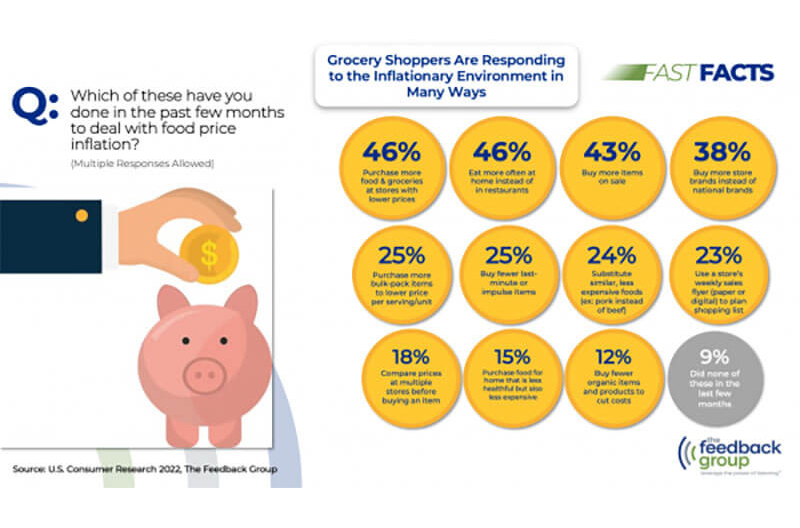

With food and beverage prices significantly higher in 2022, The Feedback Group asked grocery shoppers what they have done over the past few months to deal with food price inflation. Shoppers employ a wide range of strategies to cope, foremost being purchasing more food and groceries at stores with lower prices (46 percent have used this strategy), eating more often at home instead of restaurants (also 46 percent) and buying more items on sale (43 percent).

Other common strategies include buying more store brands instead of national brands (38 percent), purchasing more bulk-pack items to lower the price per serving/unit (25 percent), buying fewer last-minute or impulse items (25 percent), substituting similar, less expensive foods (24 percent) and using a store’s weekly sales flyer to plan their shopping list (23 percent). Additionally, some shoppers compare prices at multiple stores before buying an item (18 percent), purchase food for home that is less healthful but also less expensive (15 percent) and buy fewer organic items and products to cut costs (12 percent).

“Grocery shoppers are dealing with food price inflation in a number of significant ways, with nearly half moving their purchases for food and groceries to stores with lower prices and eating more at home instead of restaurants, as well as buying more items on sale,” said Brian Numainville, a principal with The Feedback Group. “ Further, nearly four out of 10 grocery shoppers indicate they have been buying more store brands instead of national brands, and our research shows that 75 percent of shoppers agree that the prices of private or store brands were a lot less expensive than national brands.”

Doug Madenberg, chief listening officer with The Feedback Group, added, “Our study shows that food inflation is having a tremendous impact on supermarket shopping behavior. More than 90 percent of shoppers have employed at least one money-saving strategy to deal with the impact. It’s critical that grocers merchandise and communicate in ways that show their customers they are part of the solution.”

Shoppers Looking for Lower Prices in Meat, Dairy and Produce

Shoppers were asked what one item they would like supermarkets to lower the price on. The category with the largest number of responses, meat, had more than double the number of responses of the next highest category, dairy items (with milk mentioned most).

Produce had the third highest number of responses (about evenly split between fruit and vegetables).

Shoppers’ Perception of Supermarket Profitability Is Considerably Higher Than Reality

Grocery shoppers were asked, from the money spent at their primary store, how much they think is left for profit, after the store pays all expenses and taxes. On average, shoppers indicated they believe their primary store has a net profit of 33 percent. According to FMI – The Food Industry Association, the average net profit for a supermarket has been close to 1 percent historically (and as high as 3 percent in 2020).

“Clearly, grocery shoppers believe that the stores they shop are far more profitable than they actually are,” Madenberg stated. “This inflated view of profits certainly leads some shoppers to think that food stores simply aren’t doing enough to keep prices down.

“I think most grocers had a hunch about this misperception, but the actual 33 percent net profit figure is extremely telling,” he said.

Shoppers’ off-base perceptions likely feed into their middling ratings of supermarket price competitiveness (average of 3.95 on a five-point scale) and only slightly higher marks on value for the money spent (4.18 on average).

More findings from The Feedback Group’s national consumer research will be released in the coming weeks.

The Feedback Group offers a broad spectrum of research, consumer insight and consulting services. As a 360-degree listening partner, The Feedback Group provides services include employee experience assessments, customer satisfaction programs and consumer perception studies, as well as national, regional and local shopper studies. For more information, visit feedbackgroup.com.