(Editor’s note: This is the first in a three-part series covering the release of the annual Power of Meat report. Parts two and three will appear Thursday and Friday.)

In what was described as another unusual year – with the ongoing COVID-19 pandemic, inflation and supply chain challenges – “meat really remained top dog,” said Anne-Marie Roerink, principal of 210 Analytics and presenter of the 17th annual Power of Meat report.

FMI and the North American Meat Institute hosted an online presentation of the report March 8.

Meat performance

In the past year, people bought meat “slightly less often but spent a little more each trip due to inflation,” according to the report. Dollar sales increased slightly while volume sales declined.

“Beef continued to dominate but only lamb was able to grow pound sales, albeit off a small base,” the report stated, citing data from IRI.

“If you look across the entire store and across the perimeter, in 2019 the shares between produce and meat weren’t all that different,” Roerink said. “But we really hopped a big jump in share in 2020 and remained very high in the 2021 share, saw a little bit of increase in deli/prepared, cheese and meat as well, and seafood had a little bit of an increase. Doing well in meat…is really important to the financial success of the entire store because of that financial impact.”

Roerink cited three big influencers for the year: the level of inflation; the industry’s ability to meet demand; and the 2020 performance setting the path to continued growth.

Engagement numbers were “up a little bit ahead of the enormous records of 2020, which I personally never thought would be possible. We did fall a little bit short, 5.6 percent, of the volume performance,” Roerink said.

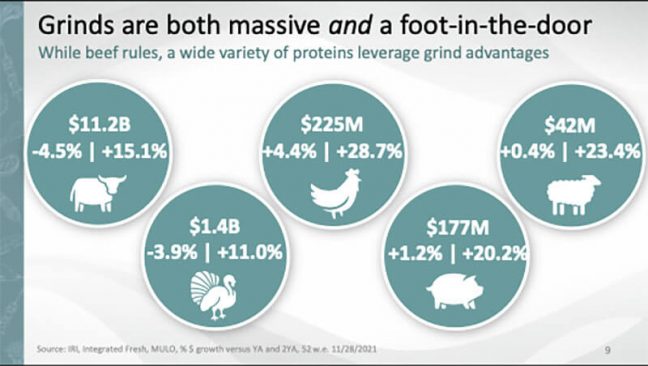

Going a bit deeper and looking at other proteins, beef is “absolutely king of the castle,” she said.

Grinds are also showing positive numbers, with ground beef coming in at more than a third of total dollars, at $11.2 billion, in 2021. Grinds also are where innovation is happening, she said, as they are versatile and people feel comfortable preparing them.

“That’s why we’re seeing that ever-expanding brick road, as I call it, where it used to just be beef. Now you’re seeing a whole lot of experimentation, including flavored meats in that area,” Roerink said.

In the area of processed meats, bacon and packaged lunch meat have managed to post increases both over a year ago and in volume. Retailers are experimenting with a variety of flavors in bacon and sausage is beginning to pop up more in meal kits.

“I predict this will be a continued area where the meat case is going to see a lot of innovation, which is a great thing to see,” she said.

Market conditions

According to Roerink, there was “great recognition” of market conditions among shoppers surveyed, with 75 percent noting higher meat and poultry prices. They also indicated there were fewer meat and poultry promotions available and, if a promotion was found, it wasn’t as good as it used to be.

Compared to pre-pandemic levels, every area of meat was down with the exception of plant-based meat alternatives, which saw an increase in promotions versus two years ago.

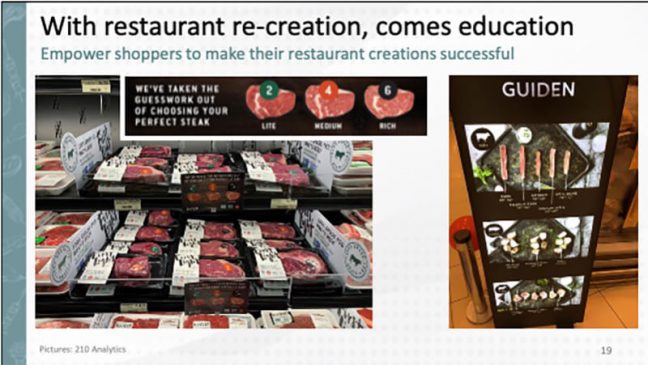

One of the first things people do is cut back on restaurant spending, Roerink said. However, she added that among those looking to cut back in that area, 62 percent seek to recreate restaurant meals at home.

“That is a huge opportunity for the meat department and every department connected to the meal,” she said. “We saw very high interest among online shoppers and among parents and also in the related opportunity that is home entertaining.”

Retailers need to figure out how to help people create dinner instead of just selling them food, according to Roerink.

“We look at what dominates their purchase decision right now in terms of meat,” she said. “It is absolutely that combination of quality or appearance to get a good price and it’s either price per pound or total package price. So that means it is not about being cheap, but it is about value – the combination.”

Getting the word out about sales or promotions has changed over the years, with shoppers now getting that information primarily from in-store promotional signs as well as a store app. To Roerink, it is “incredibly important” to start steering more shoppers to the digital information that is available to them.

“Keep talking about the coupons, use the QR code, have people sign up for an email list because driving digital engagement will be crucial for the next couple of years,” she said.

Meat consumption

Seventy-four percent of Americans say “meat eater” best describes how they eat today, according to the Power of Meat report. That percentage was 85 percent in 2019 and 71 percent in 2021.

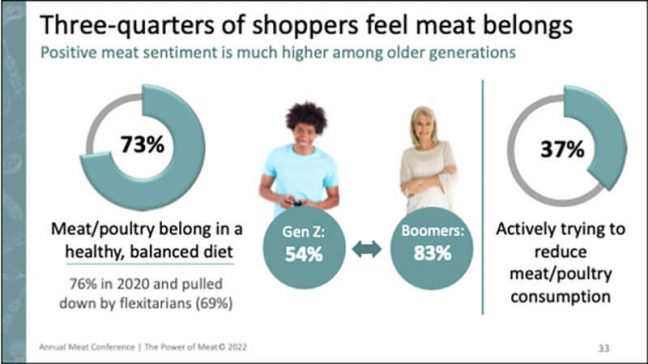

“We see way more people describe how they eat today as that being of a meat eater than that of a flexitarian, vegetarian, vegan or pescatarian,” Roerink said.

Nearly three-quarters of meat shoppers agree that meat and poultry should be part of a healthy, balanced diet, the report stated. There is a generational difference and it will take some work to ensure the younger generations think as favorably of meat in the diet as the older ones, Roerink said.

A bit more than one-third is trying to eat less meat and poultry. According to Roerink, this can be attributed to the areas of animal welfare, health, planet and social responsibility.

She said the idea of communicating animal welfare standards is important.

“It is really about the retailer saying we source from farmers we know and trust,” Roerink said. “And give that kind of ability for the consumer to also have the transparency to understand where your meat comes from, often times through online resources on the brands or the websites.”

“Shoppers’ Meat IQ is higher than ever, and the Power of Meat shows they are looking for even more ways to purchase meat and get inspiration for preparing meals,” said Rick Stein, VP of fresh foods for FMI—The Food Industry Association. “Retailers are constantly working to give shoppers more choices in the meat department and further enhance in-store and online shopping options.”

The Power of Meat study was conducted by 210 Analytics on behalf of FMI – The Food Industry Association and the Meat Institute’s Foundation for Meat and Poultry Research and Education.