by Michael Uetz / Managing Principal, Midan Marketing, strategic meat marketing, research and creative communications agency

As we slip into a new year, the Midan Marketing team has been looking at which trends from 2021 we believe will stick around as well as those new trends we can expect to see in 2022. Our blog detailing 2022 trends for the meat industry is available on our website, but we want to expand on some of the upcoming year’s retail meat trends.

Two of the trends that will be especially important for grocery retailers to consider are both related to convenience – meal kits and consumers’ omnichannel buying strategies.

Meal Kits

During the pandemic, consumers’ need for both convenience and inspiration for meals at home caused a boost for meal kit sales.1 While most consider this category to be made of services like Blue Apron and HelloFresh, we’ve also seen an increase in retailer-made meal kits available in-store. For example, at Texas-based retailer H-E-B, their Meal Simple line contains a variety of meals – from steak dinners to soups and sandwiches – available in-store. Some of these items, like the sandwiches, are ready-made and intended to be eaten cold; other items require simple reheating while the majority come with easy instructions for baking.

A new line of retail meat kits, Kitchen Table from FreshRealm, is also designed to capitalize on this demand for simple meal solutions. This product offering includes oven-, stovetop-, microwave and slow cooker-ready meals that are chef-tested and made with all levels of home cooks in mind.

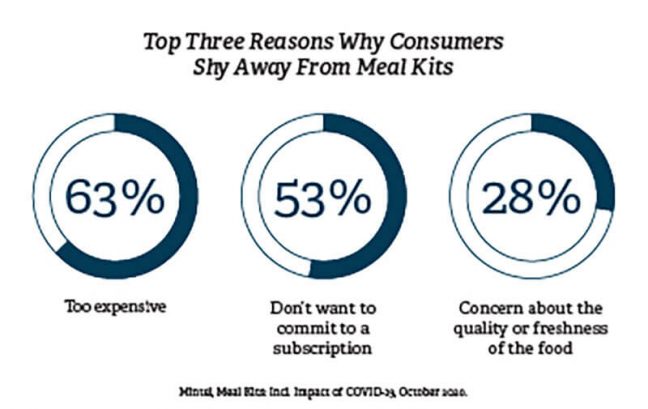

In-store meal kits can help your store meet shopper expectations by offering the benefits of meal kits while also solving for consumers’ main concerns. The top three reasons why consumers shy away from meal kits1 are a concern that the products aren’t fresh (but in-store, shoppers can look at the products and evaluate freshness themselves), they don’t want to commit to a subscription service (which isn’t necessary in-store) and they’re too expensive (which ideally could be solved in-store since retailers don’t have to factor in the cost to ship the meals to consumers’ doors). Instead, shoppers are just getting the benefits of the meal kits – ease of cooking, opportunity to try new cuisines and flavors and meal inspiration.1

According to Mintel, 60 percent of shoppers either already purchase meal kits in-store or are interested in trying them.1There are many ways for retailers to provide convenience and meal inspiration for shoppers, but in-store meal kits are one that has proven successful. With this success, retailers are offered the opportunity to evolve offerings to keep consumers engaged and satisfied.

Omnichannel

Many grocery shoppers turned to curbside or delivery for the first time during the pandemic. Those who had used it before started using it more regularly. In a recent Midan survey, nearly 60 percent of meat consumers purchased meat online in the month prior – with the most popular online ordering methods being pickup or delivery from a local grocer.2

This has led many retailers to make investments in, and improvements to, their omnichannel retailing experience. In March 2021, Albertsons partnered with Google to “reimagine grocery shopping.” This partnership brings a number of Google’s technologies like Google Pay to the stores but also works toward finding new technologies to make the grocery shopping experience more seamless.3

Walmart announced in February 2021 that it would be investing $14 billion in capital investments, largely to focus on expedited grocery e-commerce. According to Mintel, “Walmart realizes that omnichannel shopping is the future of grocery and with this investment, intends to focus on and improve its current offerings so customers can continue to choose how they want to shop, whether that be in-store, curbside pickup or delivery to their home or another secure location.”4

Regional and smaller store chains are also making investments to expand their omnichannel presence. Discount grocer ALDI added curbside pickup to 500 stores in 20215 and H-E-B opened its first pickup and delivery-only store in San Antonio, fulfilling online orders from a warehouse with no customer access.

This should be a signal to retailers of all sizes to critically evaluate their online shopping experience to find areas for improvement. We know that about a quarter of meat consumers will be purchasing “most” or “all” of their meat products online post-pandemic.2 And, these shoppers expect to have the same assortment, information and promotions that are available to in-store shoppers.

As consumers continue working into a new normal, retailers who can make that new reality more convenient will become a regular part of their routine. While consumers have many expectations and they are always changing, meal kits and omnichannel shopping are two that are expected to see growth in 2022.

1 Mintel, Meal Kits: Incl. Impact of COVID-19, October 2020.

2 Midan Marketing, Meat E-Commerce Survey, March 2021.

3 The Shelby Report, Albertsons Cos., Google Partner to Reinvent Future of Grocery Shopping, March 2021

4 Mintel, Grocery Retailing – US, April 2021

5 The Shelby Report, Aldi Continues Expansion With Plans To Open 100 New Stores in 2021, February 2021