Sponsored content

by Michael Uetz / managing principal, Midan Marketing, strategic meat marketing, research and creative communications agency

Last year, sales were up across most of the grocery store. Meat snacks – like jerky and protein lunch snacks – did not have the same success. Working from home, e-learning and  generally staying inside wasn’t conducive for the sales of on-the-go, protein-packed snacks.

generally staying inside wasn’t conducive for the sales of on-the-go, protein-packed snacks.

As the nation continues to re-open, these categories are seeing improved performance. As shoppers are reaching for these products again, though, are they reaching for the same-old option or are there new innovations in meat snacks that consumers are gravitating toward?

Jerky

After performing poorly early in the pandemic, jerky has made a strong recovery in the first part of 2021. According to data from IRI, dollar sales of jerky have increased 18.2 percent year-over-year.1 Around the same time last year, the category had only grown about 1 percent year-over-year.2

“Propelled by March, April and May 2021 sales, jerky has had a strong performance in the last year,” explained Erkin Peksoz, IRI consultant. “This is likely due to increases in outdoor activity and vaccination rates. The category growth has been evenly distributed across the top brands with eight out of the top 10 brands posting growth figures above the 18 percent category average.”1

At the top of the category is Jack Link’s with annual sales that make up nearly half of the category’s $1.9 billion sales. Jack Link’s, as well as most of the other top 10 jerky brands have one thing in common – bold nutrition information front of pack. The jerky category clearly knows who it is targeting – consumers looking for a high protein snack.

Looking at the smaller brands with the highest percentage growth in the last year – No Man’s Land, Mingua Beef and Cattleman’s Cut – there are two other commonalities: a “natural” callout on the package and outside the box flavors, like Garlic & Onion from Mingua Beef.1

Considering today’s consumer mindset, it’s not surprising that these elements are contributing to products getting noticed. When it comes to salty snacks like jerky, 22 percent of consumers say it’s important that their snacks don’t contain artificial ingredients. About the same number say they choose products with a health focus.3 These same factors play into shoppers gravitating toward front of pack nutrition callouts.

With high protein, low carbohydrate diets being some of today’s popular eating trends, consumers want nutrition information to be up front and easy to understand. In the actual meat case, 57 percent of shoppers say they want to see protein highlighted on pack4 – this is likely higher in the snack aisle where CPG brands started using nutritional callouts years ago.

As for fun, exciting and innovative flavors – consumers are specifically craving that, too. Thirty percent of shoppers say “new flavors” is an attribute they look for when choosing a salty snack. Additionally, about a quarter say meat snacks provide a good variety of flavors.3

Several other jerky brands – both on and off the Top 10 list – follow this same pattern for attracting customers. Tillamook Country Smoker jerky (the No. 5 jerky) features protein, carbohydrate and sugar callouts on the front of the package as well as a “no artificial ingredients” callout alongside others. Chomps sells a variety of meat sticks with Whole 30, Keto and Paleo certifications on back. Finally, biltong and kid-targeted meat snacks are newer additions to the category.

Protein lunch snacks

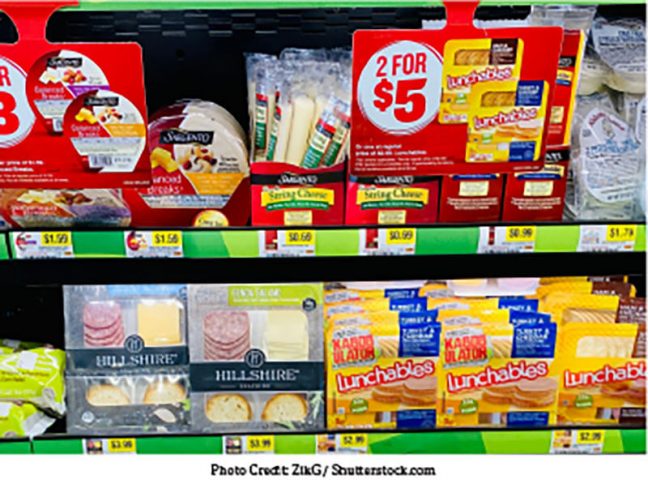

This category, which includes Lunchables and the more grown-up versions like Hillshire Snack Packs and Sargento Balanced Breaks, contains pre-packaged snacks with meat, cheese, crackers and sometimes fruits or nuts. As children and adults both ate fewer packed lunches last year, these go-to snacks were replaced with meals cooked in-home.

“Recovering from the pandemic lows, protein lunch snacks outperformed total general food sales in the latest 52 weeks,” Peksoz said. “Similar to jerky, the performance of March, April and May 2021 was very strong. Those three months generated the category’s highest sales figures since January 2020.”

This category, with nearly $3 billion in sales, is dominated by Lunchables but also contains items like the Hillshire Snacking packs. These products, which are sometimes labeled and sold as charcuterie packs, can serve as meals or snacks, in line with the Midan Marketing charcuterie research. Thirty percent of meat consumers said in the research they make charcuterie boards as a snack and about the same number – 31 percent – said they serve as a great no-cook dinner.5

Brand performance within this category was mixed, with some of the top brands hitting higher year-over-year sales figures and others seeing dips. Specifically, some of the brands with a younger focus (like Armour Lunch Maker and P3) saw diminished sales numbers in the last year. The brands and items with the high sales increases were Sargento Balanced Breaks and Hormel’s Party Trays.1 The growth in party trays shows a pandemic trend that could continue past restrictions – on nights when there’s too much happening to cook, party trays offer a one-step, do-it-yourself dinner option.

Rinds, crisps and chips

The other highlight in the meat snacks area is pork (or other meat) rinds. These products often feature innovative flavors and are lauded in many diet communities as the perfect Keto/Paleo/high-protein snack.

Recently, other brands like Flock have introduced new products into this space. Flock makes “chicken skin crisps” with packaging that highlights the nutritional aspects of the snack. A different brand, Wilde, makes chicken chips in popular flavors ranging from Nashville Hot to Chicken & Waffles.

We expect to see sales numbers for snacks continue to increase as more people are comfortable being out in the world again. More traveling and outdoor activities lead to a higher demand for portable, on-the-go protein snacks. As meat marketers, our goal at Midan is to remind consumers that meat is a great option for Monday night, movie night or the long car ride to the beach. Highlighting nutrition on pack and keeping flavors on trend are two ways to help shoppers remember that meat is part of a healthy diet – even at snack time.

1 IRI POS Syndicated Data, MULO+C, 52 weeks ending 5/30/2021

2 IRI POS Syndicated Data, MULO+C, 52 weeks ending 6/28/2020

3 Mintel, Salty Snacks – US, April 2021

4 Anne-Marie Roerink, Principal, 210 Analytics LLC, The Power of Meat 2021: An In-Depth Look at Meat Through the Shopper’s Eyes, Report sponsored by Sealed Air Food Care Division/Cryovac® and Published by Food Marketing Institute Foundation for Meat & Poultry Research & Education

5 Midan Marketing, Multicultural Meat Consumer Survey, March 1-5, 2021