Sponsored content

By Michael Uetz, Managing Principal, Midan Marketing, meat marketing specialists since 2004

The meat case has changed significantly in the last decade, but so has the consumer. Today’s meat shopper has a lot on their mind when making meat purchase decisions – sustainability initiatives, product convenience, food safety, animal welfare, the use of antibiotics and hormones, their own and their family’s health, food security, brand transparency.

We at Midan Marketing have studied consumer concerns across the board and narrowed our focus to four pillars that we believe ultimately ladder up to the shopper’s ability to trust the store, the brand and the product they are buying: sustainability, health, transparency and convenience. We recommend focusing your program initiatives on these four key drivers to keep consumers coming back to your meat case.

Sustainability

A hot topic in many industries, sustainability has become a big question mark at the meat case. More than 70 percent of Americans say they are “worried about the environment” and nearly half believe that brands and companies have a responsibility to “do what’s best for the earth.”1,2 But beyond that, consumers aren’t certain what sustainability really means – especially when it comes to meat products.

When asked in April 2020, consumer definitions of food sustainability ranged from items being locally sourced, non-GMO, organic or sometimes even related solely to the packaging.3 These early pandemic definitions were already varied and likely evolved even more as summer 2020 news headlines repeatedly and falsely called out how modern meat production “isn’t sustainable.”

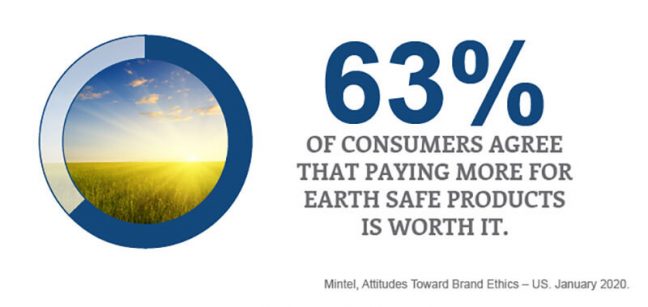

The good news for sustainability is that consumers aren’t expecting brands and companies to bear the full burden. Consumers are willing to take on some of the cost of environmental sustainability with 63 percent in agreement that paying more for earth safe products is worth it, with ages 25 to 44 indexing even higher.1 Of course, the environment is but one part of the issue.

Economic and social considerations like family and community also play into the sustainability story. The challenge here is listening to shoppers to learn what aspects of sustainability they believe are important, then working with suppliers and brands to tell the stories of how their companies and products are working toward the same goals as the consumers. Educating the consumer on the efforts farmers, ranchers and the meat industry are already taking – in their terms – will be important in this effort.

Health

COVID-19 put a spotlight on health and wellness in a way that none of us could have imagined. In January, 68 percent of meat consumers were fearful for their own health and 83 percent said they were fearful for the health of others.4 This has led some consumers to make different food choices that they perceive to be more healthful. Twenty-nine percent of U.S. adults say they’ve been stricter about making healthy choices for themselves due to the health crisis and 30 percent of U.S. parents say they are making stricter choices about their kids’ food.5

Luckily for the meat case, the food attribute most currently tied to health in the mind of the consumer is “fresh” with 66 percent of shoppers saying they equate healthy foods with freshness. Then, a majority of consumers are turning to nutrition labels to inform their healthy choices. More than 40 percent of shoppers connect “all natural” products to being better for their health and nearly the same number are focusing on a product’s protein content to determine if it’s the best option for their body.5 For the grocer, addressing this concern can be as easy as merchandising products with clear health claims and educating shoppers on nutrition labels when needed.

Transparency

In the age of endless information, transparency has become a key issue for consumers, especially younger generations. According to Mintel, 74 percent of consumers agree that food companies should be more transparent about their farming practices – this jumps to nearly 80 percent when asking millennials alone.6

This ties closely to animal welfare, where shoppers aren’t hearing the messages the agriculture industry would like. In 2020, there were nearly four times as many negative conversations about meat and the meat industry on social media than there were positive ones.7 The negative coverage animal agriculture received in 2020 can be difficult to overcome, especially when 43 percent of consumers say animal welfare influences their meat and poultry purchases.8

Half of U.S. shoppers say it’s important to research the business practices of brands they buy from. Between 40 percent and 60 percent of consumers are looking into issues like companies’ sustainability efforts, whether or not products are safe for the earth and animal, if the company appears to respect their employees and even whether a brand’s leadership speaks up about social issues.1

Address these concerns by stocking quality products from trusted brands. Being able to speak directly about the brands and companies your shoppers have questions about will help foster additional trust with your customers. When it comes to the issues of animal welfare and the environment, try partnering with a local meat producer to give the public an inside view at what real meat production looks like. Another educational avenue is highlighting content from the meat brands you carry, focusing on how they handle animal welfare and caring for the environment.

Convenience

Last year forever changed what “convenience” means when it comes to grocery retail. According to IRI Consultant Erkin Peksoz, the pandemic accelerated e-commerce sales by three to four years. This equates to year-over-year dollar sales growth of 53.4 percent for grocery e-commerce. During the same time period, e-commerce dollar sales for refrigerated meat rose 94.3 percent.9 Now, 30 percent of meat consumers say their primary method of purchasing meat after COVID-19 ends will be an online source.4 This number may continue to increase over time, especially as grocers and brands work to make buying meat online even easier.

Adoption of online meat purchasing was slow before the pandemic and for good reason – it can be difficult for consumers to trust a stranger to choose the same fresh meat product they would have picked for themselves. Grocers have an opportunity to educate shoppers on how meat is chosen when purchased online for delivery or pickup. To go a step further, consider improving app or website functionality so consumers can provide more detail on the color, size or shape of the meat item they’re looking for or even approve the specific cut chosen before it makes it into the cart.

Trust, Storytelling and Branding

Sustainability, health, transparency and convenience all contribute to the consumer’s ability to trust a brand, company or product. As sustainability continues to be an important topic, especially as it relates to the environment, shoppers may feel more trusting toward brands that are making and achieving their sustainability goals. When it comes to health, consumers will make choices based on their own preferences, but ultimately trust their grocer to sell them healthful products.

Storytelling is a key component of being seen as transparent, which builds trust. Being able to trust the products themselves is an important element within convenience, where shoppers are still learning to trust others to pick their fresh food.

A branded meat case full of products with colorful producer stories is one way to address many concerns at once. Branded products, in addition to being more transparent about sustainability and other efforts, can more easily boast nutrition claims on package. Additionally, once shoppers find a product they like, it’s easy for them to trust the eating experience will be the same every time.

Throughout the year, Midan Marketing will take a deeper dive into each of these topics (and more) to understand where the meat consumer is today and what they expect from their meat – and their retailer – in the future. To be notified when our sustainability research is released, fill out this form.

1 Mintel, Attitudes Toward Brand Ethics – US. January 2020.

2 Mintel, American Lifestyles (Incl. Impact of COVID-19) – US. August 2020.

3 International Food Information Council, 2019 Food and Health Survey. May 2019.

4 Midan Marketing, COVID-19 Survey Results, Wave 9. January 2021.

5 Mintel, Better for You Eating Trends (Incl. Impact of COVID-19) – US. November 2020.

6 Mintel, Food Ethics – US. February 2020.

7 Midan Marketing, Meltwater Social Listening, 52 weeks ending 12/31/2020.

8 Anne-Marie Roerink, Principal, 210 Analytics LLC, The Power of Meat 2020: An In-Depth Look at Meat Through the Shopper’s Eyes, Report sponsored by Sealed Air Food Care Division/Cryovac®

9 IRI POS Syndicated Data, 52 weeks ending 10/4/2020.