by Eric Pereira / staff writer

If there’s a don’t-miss session at the Annual Meat Conference, it’s the Power of Meat. And this year’s presentation, held Tuesday as part of the virtual event, didn’t disappoint.

Anne-Marie Roerink, principal with 210 Analytics, told the audience that it’s important to look in the rearview mirror and “understand what happened in 2020 and, more importantly, why.”

“Let’s understand what the performance was, why it happened, what’s the role of meat in the diet,” she said. “And from there on out, let’s take a walk down the path to purchase to understand the lessons of yesterday to understand our pockets of growth tomorrow as we are going to go up against one of the biggest years in the history of food retailing.”

The Power of Meat study was conducted by 210 Analytics on behalf of FMI – The Food Industry Association and the Meat Institute’s Foundation for Meat and Poultry Research and Education. Shopper input was combined with IRI sales results to outline red flags and opportunities for those in the meat industry.

The national analysis consisted of 1,501 shoppers in January 2021, leveraging 16 years of trend lines. Roerink keyed on understanding the path to purchase in 2020, with the multiple effects of the ongoing COVID-19 pandemic on consumer behaviors.

According to Roerink, one of the most profound differences was change in grocery trips and baskets.

“We already were the largest fresh department and 33.7 percent of fresh dollars in 2019. But in 2020, because that enormous sale and love for meat, we rose to 35.8 percent of total perimeter sales,” she said.

While sales have been up, the number of meat eaters has been declining. At the same time, consumers who identify as flexitarian – eating meat every couple of days – is “increasing tremendously.”

Roerink pointed this out in their trend line between 2019 and 2021.

“And that is something that we need a red flag, we need to understand what prompts those behaviors,” she said.

Roerink went on to present various interviews to show how consumers feel about various topics, including the types of meats purchased, new cooking appliances and opinions on animal welfare.

Top findings from the “Power of Meat” reflected the continued popularity of meat and poultry.

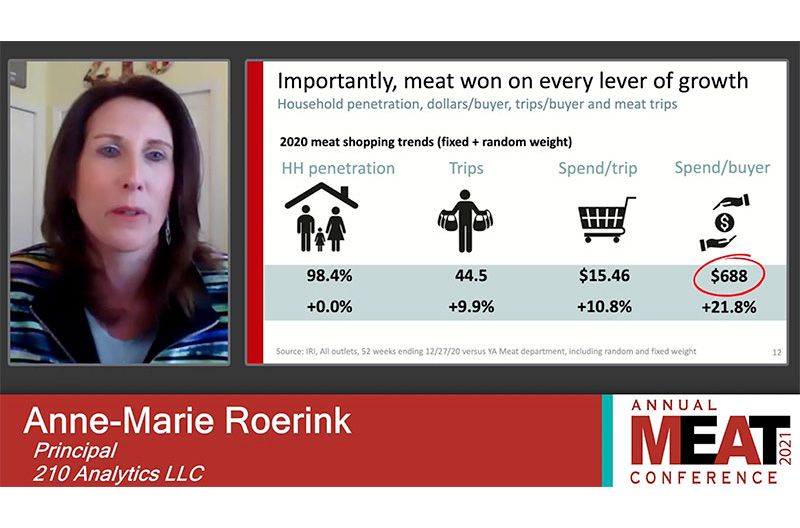

“With consumers cooking at home during the pandemic, meat department dollars increased 19.2 percent and volume 11 percent,” Roerink said.

She attributed this to more meat trips and greater spending per trip, while household penetration remained high, at 98.4 percent.

The report found that three out of every four Americans agree meat belongs in healthy, balanced diets (up by nearly 20 percent since 2020) and 94 percent say they buy meat because it provides high-quality protein.

Among the “Power of Meat” report’s other findings was that more than three-quarters of shoppers changed something about their meat purchases during the pandemic.

Driven by lunch and dinner, 43 percent of shoppers bought more meat and poultry, greatly impacted by the work-from-home trend. Additionally, four in 10 shoppers bought differently, whether different types (42 percent), cuts (40 percent) or brands (45 percent).

The Annual Meat Conference continues through March 25.