Sponsored content

by Michael Uetz / Managing Principal, Midan Marketing, meat marketing specialists since 2004

The COVID-19 pandemic has put health in the spotlight. During the tumultuous year that was 2020, personal health and the health and well-being of others was repeatedly a concern of consumers.1 When it comes to the meat case, consumers often equate “health” to natural, organic, antibiotic free and a slew of other claims-based meat products.

In March and April 2020, sales of claims-based meat spiked – likely because out-of-stocks led consumers to purchase anything that was available. However, according to data from IRI, sales volume of claims-based meat outpaced the growth of conventional meat through the summer and into the fall. During the height of the pandemic, organic beef saw volume growth of 45 percent while non-organic grew only 14 percent.2 In pork, it was meat with antibiotics claims that took off. Antibiotic-free pork grew 20 percent during the pandemic, compared to only 13 percent of pork without the claim.3

By the end of 2020, about 10 percent of regular natural and organic meat purchasers* converted to claims-based meat during the pandemic. But the real growth story comes from the fact that 35 percent of organic and 27 percent of natural meat shoppers said they are purchasing even more claims-based meat since COVID-19 began. The answer when asked why they are purchasing more? Health, health, health.4

Since health continues to be a topic of discussion and more shoppers than ever are picking up claims-based meat, it’s important to know who these consumers are and how they are shopping for their meat products of choice.

Natural or Organic?

Let’s consider what it means for meat to be “natural” or “organic.” According to the USDA, “natural meat” is a product containing no artificial ingredients or added color and is only minimally processed. While it may not be on every label, nearly all fresh meat falls under the USDA’s definition of “natural.”

“Organic,” on the other hand, is a USDA-certification that meat animals are raised in living conditions accommodating their natural behaviors (like the ability to graze on pasture), fed 100 percent organic feed and forage and not administered antibiotics or hormones.

About 70 percent of natural meat shoppers say they know the definition of the “natural” claim; another 22 percent believe they might know the definition.4 However, when asked if they agree with statements about characteristics of natural meat, we see an opportunity for education. About 70 percent of natural meat consumers believe that natural meat “comes from animals that are given no added hormones” and 64 percent say it “comes from animals that are never given antibiotics.” Similarly, about 80 percent of organic meat purchasers agreed that organic meat comes from animals that are never given antibiotics or hormones.4 The difference, though, with organic meat is that those assumptions are all partially correct.

In the Natural & Organic Meat Purchaser Survey Midan Marketing conducted in December 2020, we found that the natural purchaser was essentially “organic-lite.” On nearly every topic, if natural purchasers agreed, slightly more organic purchasers would also agree. This tendency is also reflected in their concerns about COVID – 76 percent of natural meat purchasers are very or extremely concerned about COVID-19. This percentage inched slightly higher to 78 percent of organic meat shoppers.4

Both natural and organic meat purchasers are interested in many more issues than the general U.S. meat consumer. Some of the attitudes are to be expected – such as the 35 percentage-point difference between the natural and organic meat purchasers’ willingness to pay more for “organic” meat than the general meat consumer. But other attitudes are more surprising. Eighty percent of U.S. meat consumers say they eat meat because it tastes good – 86 percent and 87 percent of organic and natural meat shoppers, respectively, say the same thing. Similarly, natural and organic consumers come in about 10 percentage points higher than the general meat consumer in believing that meat is the best source of energy. 4,5

While the general attitudes of the natural and organic shoppers are similar, their shopping habits begin to diverge, and their eating habits truly show how different they are. By and large, natural and organic meat shoppers purchase their meat at the same place they purchase the rest of their groceries. For the majority of these shoppers, that place is a traditional, full-service supermarket. Trailing slightly is the supercenter, coming in as the No. 2 shopping destination for both groups.

Where these groups begin to differ in shopping behaviors is that 40 percent of organic meat purchasers have shopped in-person at a health, natural or organic food store in the past month, compared to only 29 percent of natural meat shoppers. 4

Another shopping behavior that differentiates the two groups (and truly makes them stand out from the general meat consumer) is online meat shopping. As of September, 53 percent of meat consumers had purchased meat online at some point during the pandemic. In contrast, 68 percent of organic shoppers bought natural or organic meat online during the month of November. Organic shoppers are also leading the growth of direct-to-consumer shopping with 21 percent having ordered from a meat-specific delivery service (like Crowd Cow or ButcherBox) in November (compared to only 9 percent of general meat consumers between March and September.)1,4

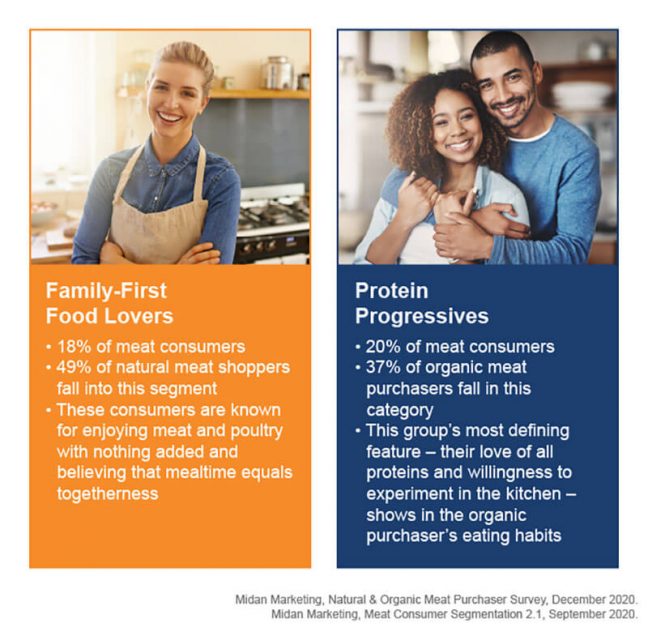

Midan’s Meat Consumer Segmentation groups show some of the largest differences between the natural and organic shoppers. The Family-First Food Lovers segment accounts for 18 percent of meat consumers – nearly half of the natural meat shoppers fall into this segment. These consumers are known for enjoying meat and poultry with nothing added and believing that mealtime equals togetherness. The Protein Progressives segment, which makes up 20 percent of the meat-eating population, skews way toward the organic meat purchaser with 37 percent of these shoppers falling in this category.4,5 This group’s most defining feature – their love of all proteins and willingness to experiment in the kitchen – shows in the organic purchaser’s eating habits. Nearly half of organic meat shoppers have eaten plant-based meat alternatives in the last month; a quarter have eaten lamb and more than 20 percent have eaten specialty meat such as bison, ostrich or goat. These numbers are all much higher than the natural meat purchaser or the non-claims-based purchaser.4

With today’s focus on health, it’s no surprise that claims-based meat is on the rise. The top reasons why natural and organic shoppers choose those products is because they are looking for “Free from” claims and a product that’s better for their health.4 Is your meat case stocked with the claims your customers are looking for? Are your specialty and claims-based meats all included on your store’s e-commerce platform? Make sure you’re keeping these premium meat dollars (and shoppers) in your store.

*Purchase “natural” or “organic” meat at least multiple times per month and at least “somewhat” agree that they try to purchase foods free from fillers, additives, dyes, etc.

1 Midan Marketing, COVID-19 Survey Results Wave 8, October 2020.

2 IRI POS Syndicated Data, 33 weeks ending 11/01/20.

3 IRI POS Syndicated Data 37 weeks ending 11/29/20.

4 Midan Marketing, Natural & Organic Meat Purchaser Survey, December 2020.

5 Midan Marketing, Meat Consumer Segmentation 2.1, September 2020.