As the traditional start of grilling season, Memorial Day was a tough week to beat in year-over-year sales. Additionally, meat sales overall were heavily impacted by the tightness in supply.

These were among the findings of in the most recent weekly report from 210 Analytics and IRI, which are tracking meat and hot dog sales throughout the COVID-19 pandemic.

During the week ending May 24, the meat case was down 48 items on average versus the same week last year, according to Anne-Marie Roerink, president of 210 Analytics.

Many stores had purchase limits in place for beef, ground beef, chicken or the total number of meat and poultry packages that could be purchased in one transaction.

Even so, overall meat sales increased 20.7 percent in dollars and 5.1 percent in volume during the week of May 24 versus year ago. While still highly elevated, this was the third week in a row sales gains declined versus the prior week, Roerink noted.

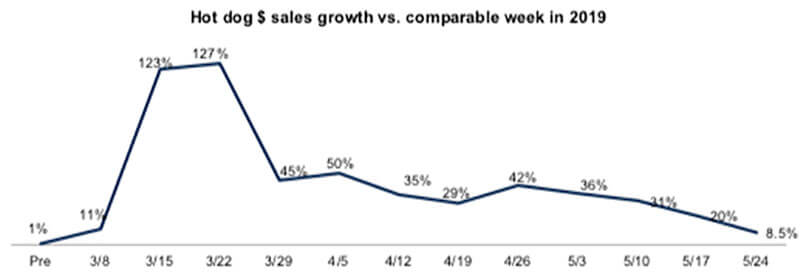

Hot dog sales patterns were similar to those seen for total meat. While hot dog sales remained elevated as well, at an increase of 8.5 percent versus the same week last year, this was the first time gains were in single digits since the first week of March, before COVID-19 dramatically changed shopping patterns and spending.

That ended an 11 week multi-digit year-over-year sales gains streak for hot dogs.

While dollars increased 8.5 percent, volume sales turned negative for the first time since early March, at a drop of 9.2 percent over the week of May 24 versus the comparable week in 2019.

As Memorial Day typically causes a big spike in hot dog sales, it is a harder week to achieve sales gains. The 17.7-point gap between volume and dollar sales continues to increase each week and points to price inflation, much like rising prices for fresh beef, pork and other proteins.

Source: IRI, MULO, 1 week $ growth versus year ago

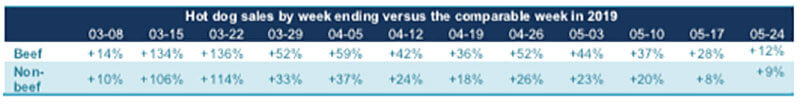

National brands vs. private label

National brands made up 97 percent of total hot dog sales the week of May 24 and grew dollar sales 8.3 percent, Roerink said.

Private label hot dog sales increased 17.5 percent, but are a small share. Beef hot dogs represented nearly 67 percent of total hot dog sales and grew the most, at an increase of 12.3 percent.

Source: IRI, MULO, 1 week $ growth versus year ago

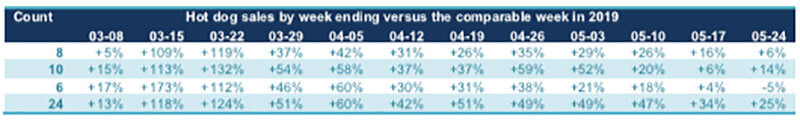

Eight-count leads way in pack sizes

The above-average sales numbers were driven by eight-count packs (the most common pack size, representing 49 percent of all sales) as well as value packs.

Larger pack sizes of 10 and 24 counts have been doing well these past few months, pointing to an increased everyday demand.

Source: IRI, MULO, 1 week $ growth versus year ago

Next week’s sales report will show whether the slow march to normalcy continues or if sales gains rebound after going up against strong Memorial Day 2019 results.