sponsored content

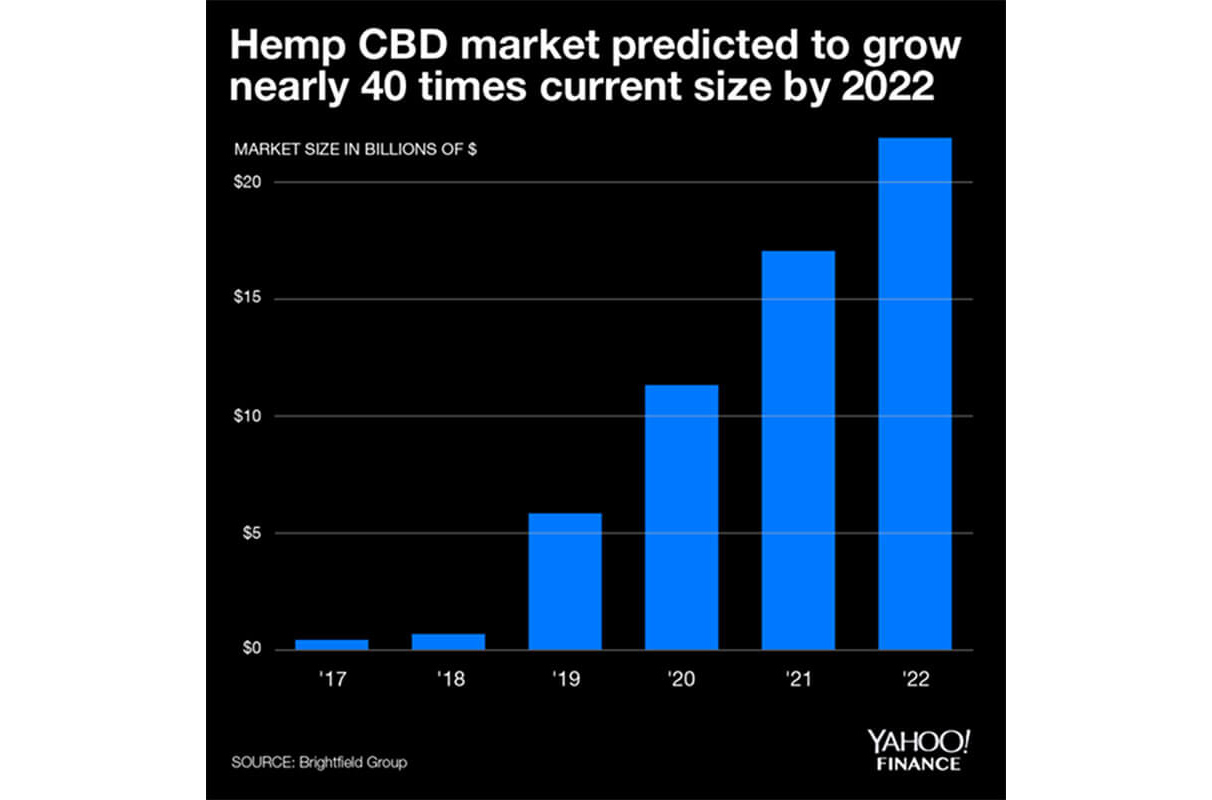

Over the past two years, there has been an explosion of hemp-derived cannabidiol (CBD) products being marketed and sold in various retail sectors. The market size for these products in the United States alone, as shown in the Yahoo finance figure above, is expected to surpass $22B in revenue by 2022. The 40-times market growth over five years may seem like fiction but if anything, these market projections are most likely conservative, says Golden, Colorado-based Panacea Life Sciences. Due to regulatory hurdles and a need for consumer (and retailer) education, the market has suppressed from reaching peak revenue potential.

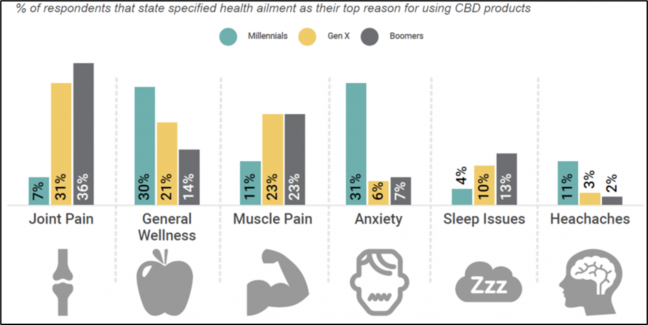

Currently, 25 percent of Americans are currently using or have tried a cannabidiol product. A majority of current users are Millennials, as this generation seems to be more comfortable with using marijuana or cannabis products. As older generations realize that CBD has no psychoactive properties and may provide a natural approach to combat various ailments due to aging, anxiety, pain and more, it is anticipated that there will be a greater demand for cannabinoid products.

An interesting aspect of CBD demographics is that different age groups use these products for different purposes, which creates unique marketing challenges. To demonstrate one aspect of market growth for retail consumer goods stores, Kroger, the nation’s largest grocery chain, started carrying topical CBD products in 945 stores in 17 states beginning in June 2019. Due to sales success, by December, Kroger expanded CBD product lines to 1,350 stores in 22 states—a 37 percent increase in stores in a mere six months. For CBD products to meet or exceed these market projections, the legality and regulations for manufacturing need to be clarified, and consumers need reliable education on how these products may be utilized for general wellness.

CBD products are in such high demand due to the wide array of health benefits that cannabinoids may provide. Cannabidiol has been reported to assist people with more than 100 different conditions ranging from acne to pain. Some of the reported effects may be hope or hype, however, there is some rationale for how CBD works in the body that lends credence to promoting overall well-being.

CBD is one of more than 113 cannabinoids found in the industrial hemp or cannabis plant. This cannabinoid is non-psychoactive compared to its more well-known relative tetrahydrocannabinol (THC), which is responsible for the euphoric high associated with marijuana. These compounds work via a large number of receptors and enzymes in the body, collectively known as the Endocannabinoid System (ECS), whose main function is to help maintain homeostasis. Looking at the tissues and organs where CBD is known to have activity may explain the wide-ranging health effects reported by CBD users. For this reason, there is a need for more research to determine what is hype and what is real so the industry can provide better consumer guidance on how these products can and should be used.

It’s important to understand that industrial hemp is a sub-breed of marijuana, Cannabis sativa L., which looks, smells and, in raw form, tastes like marijuana. What distinguishes hemp and hemp-derived products from marijuana is a low concentration of THC—less than 0.3 percent. In addition to cannabinoids, hemp plants contain numerous terpenes and flavonoids which are the compounds that give cannabis its distinctive smell and taste, but the terpenes have additional beneficial biological effects that are often overlooked.

As the hemp industry progresses with selective breeding of hemp strains and makes technological advances, formulations containing new cannabinoids will enter the market. Already in 2020, products that contain appreciable amounts of cannabigerol (CBG) and cannabinol (CBN) are being sold. Each cannabinoid may have unique actions in the body which will require research to determine potencies, safety and conditions consumers may address with these new cannabinoids.

Another notable aspect to understand is that CBD products can be made from three different CBD ingredients: full-spectrum oil, broad-spectrum oil and CBD isolate. Full-spectrum oil, or distillate, contains all of the plant including its cannabinoids, terpenes and flavonoids, essentially converting the essence of the plant into a liquid form. Full-spectrum oil does contain THC at low concentrations (less than 0.3 percent) as well as several other cannabinoids. Certain consumers prefer full-spectrum products as the multiple components can act synergistically to augment biological effects, commonly termed “the entourage effect.”

Broad-spectrum refers to a complex CBD mixture that has all the components of full-spectrum oil but has removed the THC. Typically, broad-spectrum oil is created using chromatography to split the oil into different fractions, then removing the THC fractions. Broad-spectrum products provide users the benefit of a full-spectrum oil while minimizing the possibility of positive drug tests.

CBD isolate products contain CBD without other cannabinoids or other components of the hemp plant.

Are selling CBD products legal? This is usually the first question retailers ask before deciding to add CBD products to shelves and has been a complex issue that is slowly reaching resolution. When the Agriculture Improvement Act of 2018, commonly referred to as the “Farm Bill,” was signed into law, hemp products became federally legal. Individual states have been enacting local laws to legalize hemp-derived CBD products with Idaho, South Dakota and Nebraska lagging for state-wide legalization. The 2018 Farm Bill also explicitly states that the FDA is the agency to provide oversight on the production regulations of CBD products. The FDA currently has stated that topical CBD products are allowed but consumable CBD products are not legal to market as food or dietary supplements until further research is conducted to assess safety and recommended servings or daily doses.

There are signals that the FDA will soon provide regulatory guidance regarding CBD products. Meanwhile, The World Health Organization has deemed CBD products as safe, and the European Union’s FSA (Food Standards Agency) has approved CBD as a novel food ingredient for daily servings of up to 70 mg/day.

As federal regulations for manufacturing CBD products are lacking, it is extremely important that retailers research CBD manufacturers and products to ensure their customers are receiving products that are quality-control tested for potency and purity. As reported in the June 2019 FDA hearing regarding CBD, more than 50 percent of retail products failed to have stated potency, and/or contained less than 0.3 percent THC.

When searching for a CBD product provider, it is important to understand that the company manufactures products to Good Manufacturing Practice (GMP) guidelines and that the company has either been GMP-certified or is in late stages of certification. Products should be tested by accredited third party laboratories, and the manufacturer should provide test results to customers through a QR code on the product label. Finally, manufacturers should be able to demonstrate that there is complete supply chain traceability.

With the nascent CBD industry, retailers should choose manufacturers that are committed to quality, innovative products and provide a better understanding of the scientific and medical benefit these novel products provide. It is worth stating that many CBD companies will not work toward GMP certification, as it is time consuming and expensive. However, GMP compliance will most likely be mandated by the FDA in the near future, so working with companies committed to GMP will allow for business continuity with such manufacturers. The first generation of products in this space are simply CBD put into a formula. Manufacturers who have the expertise to optimize products by combining CBD with other natural oils will provide enhanced properties. For example, developing an immune strengthening supplement could look like combining CBD with known natural immune boosters such as garlic and oregano oils, which should provide enhanced and specific effects consumers are searching for.

Lastly, preferred companies should be able to support a retailer’s staff and customer questions regarding products with scientific and medical information. Knowledge regarding the health benefits of CBD (and other cannabinoids) is minimal but growing. Manufacturers who are able to work with retailers to provide such information will greatly aid in customer understanding and ultimately product sales.