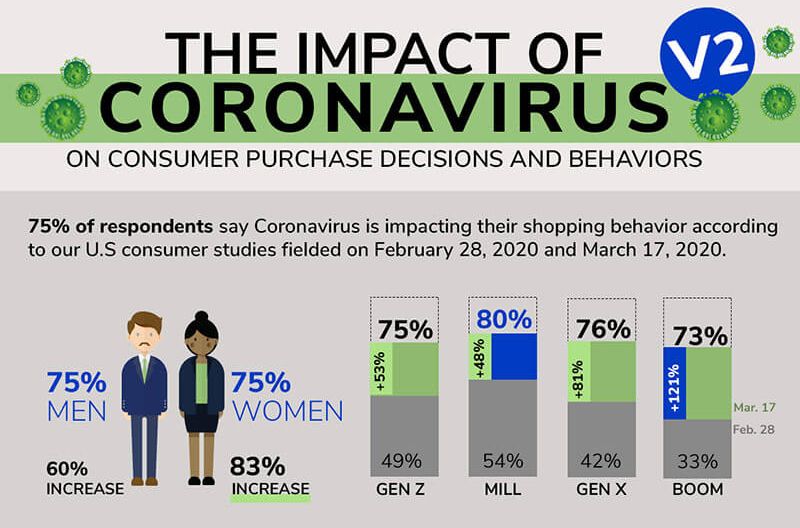

As coronavirus continues to spread, a recent survey by First Insight found that news of the virus is impacting the shopping behavior of 75 percent of respondents, up from 45 percent (a 70 percent increase) when comparing to a survey fielded in late February. The survey by Warrendale, Pennsylvania-based First Insight Inc. also pointed to significant swings in behavior by women and Baby Boomers over the last three weeks.

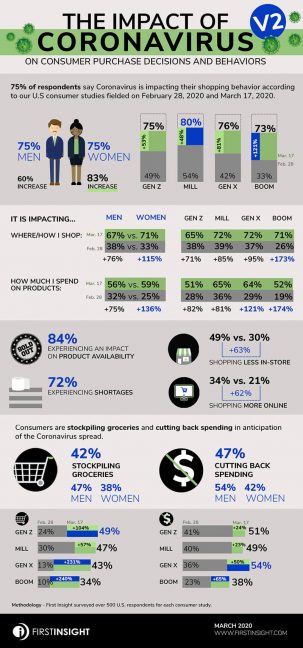

Both groups had been slower to change behavior based on coronavirus fears than their gender and generational counterparts, but are now in greater alignment. For example, 71 percent of women now say that the virus is impacting where and how they shop, a 115 percent increase from late February, compared to 67 percent of men (a 76 percent increase). Similarly, while Millennials report the greatest impact on purchase decisions (80 percent, a 48 percent increase from the previous survey), Boomers have now aligned behavior more with their younger counterparts with 73 percent saying the same, a 121 percent increase from the prior survey.

“As the number of coronavirus cases increases, the governments have reacted appropriately with more restrictions on movement and face-to-face interaction coming every day. This certainly has affected people and their perceptions of the world around them,” said Greg Petro, CEO of First Insight. “This survey shows a significant shift in behavior as consumers adapt to their new reality, whether it’s increasing purchases of staple items, moving more shopping online or cutting spending in some areas. The world looks very different than it did three short weeks ago, and things are likely to look different three weeks from today.

“Retailers, brands and manufacturers need to continue to be vigilant in providing the products customers need and want, both now and in future seasons. But, just as importantly, they need to understand what consumers want and how they feel today and into the future. That requires understanding the shifts in supply, demand and customer preference. The only way to understand that shifting environment is to engage with their customers via tools like First Insight.”

Some significant generational and gender findings include:

- Women Surpass Men on Impact of Virus on Shopping Behavior: Fifty-nine percent of women surveyed said that the virus was impacting how much they spent on products, compared to 56 percent of men.

- More Men Stockpiling Groceries and Cutting Back on Spending: With 46 percent of all respondents buying more products in anticipation of coronavirus, 47 percent of men say they are stockpiling groceries in particular, compared to only 38 percent of women.

- Boomers Show Greatest Shift in Behavior Compared to Other Generations: Immobility has had a dramatic affect over the last three weeks, with 71 percent of Baby Boomers saying it has impacted where and how they shop, up 173 percent from the last survey.

- Baby Boomers Less Inclined to Cut Back on Spending than Other Generations: While 47 percent of respondents are cutting back on spending overall, only 38 percent of Boomers say they are reducing their spend in preparation for greater coronavirus spread.

- Baby Boomers Show Greatest Increase in Those Stockpiling Groceries: Similar to men, Baby Boomers are the generation showing the greatest increase over the last three weeks, with 34 percent now saying they are stocking up versus only 10 percent last survey, a 240 percent increase.

- Women Surpass Men on Impact of Virus on How Much they Spend: Fifty-nine percent of women surveyed (and 57 percent overall) said that the virus was impacting how much they spent on products, compared to 56 percent of men. This represents a significant shift in behavior since the last survey, when 32 percent of men and only 25 percent of women felt the same. Similarly, while an equal number of both men and women felt it was affecting the products they purchase, this was a 136 percent increase for women, compared to a 75 percent increase for men.

- More Men Stockpiling Groceries and Cutting Back on Spending: Forty-seven percent of men say they are stockpiling groceries compared to only 38 percent of women. This is a 114 percent and 111 percent increase over last time, respectively. Men also show greater shifts toward cutting spending, as reported by 54 percent of men versus only 42 percent of women who took the survey. This is a 54 percent versus 24 percent increase respectively compared to the last survey.

- Boomers Show Greatest Shift in Behavior Compared to Other Generations: Seventy-four percent of Baby Boomers (and 71 percent of respondents overall) report the coronavirus impacting how often they go out in public, a 164 percent increase from the last survey. This immobility has had a dramatic affect over the last three weeks, with 71 percent of Baby Boomers saying it has impacted where and how they shop, up 173 percent from the last survey. Other generations including Generation Z (65 percent), Millennials (72 percent) and Generation X (72 percent) show similar impact, but a much less dramatic increase from the last survey.

Baby Boomers also have shifted their shopping to online significantly over the last few weeks. While overall 34 percent of respondents are shopping more online, more Generation Z (37 percent), Millennials (42 percent) and Generation X (35 percent) have increased their shopping online compared to Baby Boomers (23 percent). Only 8 percent of Baby Boomers reported shifting to online in the first survey; the growth to 34 percent represents a 187 percent increase.

Similarly, while 49 percent of overall respondents are shopping less frequently in-store, Baby Boomers show the greatest percentage increase for shopping less frequently in-store (48 percent), bringing this generation on par with younger generations including Millennials (50 percent) and Gen Z (51 percent). The number of Baby Boomers shopping less in-store increased 118 percent over the last three weeks, a significantly larger jump than other generations.

- So Far, Baby Boomers Less Inclined to Cut Back on Spending than Other Generations: Fewer Baby Boomers are cutting back on spending compared to other generations, even since the time of the last survey. Only 38 percent of Boomers say they are reducing their spend in preparation for greater coronavirus spread, compared to 54 percent of Generation X, 49 percent of Millennials and 51 percent of Generation Z.

- Baby Boomers Show Greatest Increase in Those Stockpiling Groceries: While 42 percent of respondents overall admit to stocking up on groceries, more Millennials (47 percent) and Gen Z (49 percent) are doing so than other generations. That said, Baby Boomers have shown the greatest increase over the last three weeks, with 34 percent now saying they are stocking up versus only 10 percent last survey (240 percent increase).

Similarly, Baby Boomers show the greatest percentage increase in the outbreak’s impact on spending on products as well as services. More than half of Baby Boomers (52 percent, compared to 66 percent overall) reported an impact on how much they are spending on products (a 174 percent increase over last time). While Generation Z (51 percent), Millennials (65 percent) and Generation X (64 percent) said the same, Baby Boomers showed the greatest shift overall. However, when considering impact on services such as restaurants, entertainment and travel (64 percent overall reported an impact), Baby Boomers showed the greatest percentage increase with 64 percent (a 112 percent increase) versus 62 percent of Generation Z (100 percent increase), 65 percent of Millennials (48 percent increase), and 70 percent of Generation X (53 percent increase).

- Product Availability and Shortages Driving People to Shop Online: According to the survey, the vast majority of respondents reported an impact on not only product availability (84 percent) but shortages (72 percent) and a growing number of consumers are shopping more frequently online, with a 62 percent increase (34 percent versus 21 percent). Similarly, the number of consumers shopping less frequently in-store showed a 63 percent increase (49 percent versus 30 percent).

- Nearly All Respondents Feel Coronavirus Will Impact Global Economy: Ninety-eight percent of respondents feel that the coronavirus will impact the global economy, up slightly from 93 percent at the time of the previous survey. Responses were split near equally across gender and generation. Further, 71 percent of respondents said they were “worried about the Coronavirus,” up from 66 percent at the time of the previous survey. Worth noting, Baby Boomers are now the most worried generation at 81 percent, up from 72 percent last time, with 68 percent of Generation X, 72 percent of Millennials and 64 percent of Generation Z saying the same.

First Insight’s findings are based on the results of two U.S. consumer studies of targeted samples of more than 500 respondents each, fielded on Feb. 28 and March 17. The study was completed through proprietary sample sources among panels who participate in online surveys.

First Insight is a digital product testing and decision-making platform that empowers retailers and brands to incorporate the voice of the customer into the design, pricing, planning and marketing of new products. Through the use of online consumer engagement, the First Insight solution gathers real-time consumer data and applies predictive analytic models powered by machine learning and AI to create actionable insights, which drive measurable value. Retailers, manufacturers and brands use the First Insight solution to design, select, price, plan and market the most profitable new products for reduced markdown rates and improved sales, margins and inventory turnover.