A new study by Dr. Robert Kulick of NERA Economic Consulting released Feb. 12 reveals the positive economic impact that Instacart has on the broader U.S. retail grocery industry. The study leverages statistical analysis to quantify Instacart’s role—deemed “The Instacart Effect”—in driving significant increases in retail grocery employment and revenue.

The study found that by creating additional customer demand for grocery stores, San Francisco-based Instacart increased retail grocery employment by 23,000 net jobs and drove significant incremental revenue across four states. According to the study, the entry and expansion of Instacart into local markets acts as an economic complement to grocery store employment, bringing incremental business to the store while creating an e-commerce footprint for retailers.

“Instacart is changing the way customers engage with grocery stores by creating a complementary online service that would be prohibitively expensive for traditional retailers to offer on their own. The result is increased grocery demand, which translates into higher grocery store employment and revenue. The data indicates that in 2019, “The Instacart Effect” was responsible for an increase of more than $620 million in revenue and more than 23,000 jobs in the grocery sector in California, New York, Illinois and Washington. These findings demonstrate that Instacart has played an important role in helping the grocery industry compete in a challenging economic environment,” said Kulick. “It is often assumed that disruptive innovations necessarily displace traditional modes of commerce and employment. However, with Instacart the opposite is true. While Instacart is changing the way customers interact with grocery stores, it is an example of how innovation can benefit industries and their workers.”

Using rigorous statistical methods and analyzing data from California, Illinois, New York and Washington, the study demonstrates a robust relationship between Instacart adoption in local markets and employment and revenue in the grocery industry.

Key findings of the study include:

- Grocery Employment Increases When Instacart Enters a Market—When comparing retail grocery employment prior to and following Instacart’s entry into a metropolitan statistical area (MSA), there is a direct connection between Instacart’s entry and employment. On average, Instacart’s entry is associated with a 4 percent increase in retail grocery employment in an MSA, as grocers add employees to support the increased business at their store. These roles are direct employees of grocery stores and include jobs such as cashiers, stocking associates and deli counter clerks, among others.

- Instacart Creates Net Grocery Jobs—In 2019 specifically, Instacart’s adoption was directly responsible for more than 23,000 jobs across MSAs in the four states studied. These are net retail grocery jobs that would not have existed had Instacart not entered and expanded in the market.

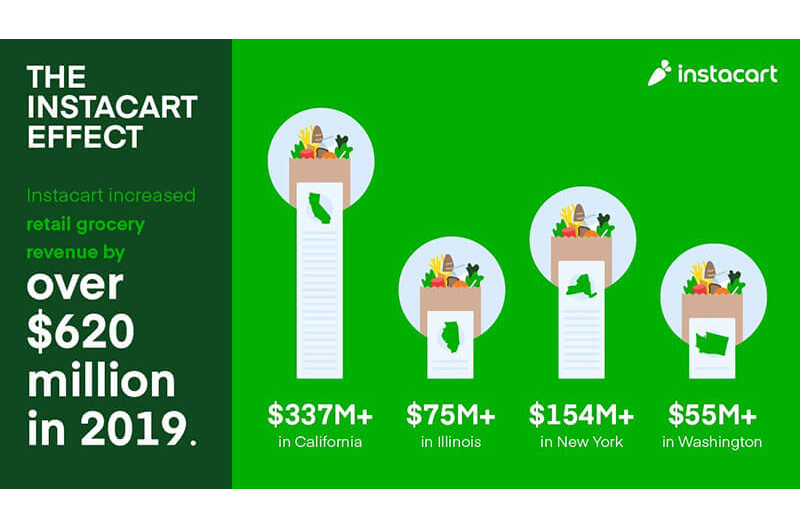

- Instacart Drives Significant Incremental Grocery Revenue—As online grocery grows, so does the revenue it drives across the grocery industry. Across MSAs, Instacart increased incremental grocery revenue by more than $620 million in 2019 alone.

- “The Instacart Effect” is a National Phenomenon—The results indicate that the magnitude of “The Instacart Effect” is statistically equivalent for each state. Thus, the findings suggest that “The Instacart Effect” is a national phenomenon.

At the state level, the study finds:

- In California, “The Instacart Effect” created more than 11,500 additional jobs and $337 million in incremental revenue.

- In Illinois, “The Instacart Effect” created more than 3,400 jobs and $75 million in incremental revenue.

- In New York, “The Instacart Effect” created more than 6,600 jobs and $154 million in incremental revenue.

- In Washington, “The Instacart Effect” created more than 1,900 jobs and $56 million in incremental revenue.

The study provides strong evidence demonstrating that “The Instacart Effect” is causal. “The Instacart Effect” is apparent in the results of three distinct statistical models, each of which is validated by seven placebo tests involving other retail industries. In comparison to retailers such as bookstores, sporting goods stores and clothing stores, Instacart showed no effect on growth for any non-grocery retail industries. This further confirms that “The Instacart Effect” directly impacts retail grocery growth and is not a false positive driven by confounding factors in the broader retail industry.

“Investing in an online retail experience is critical to the success of grocers competing for consumer attention today. The technology and fulfillment needs are complex, and the cost is prohibitive for many. But, with Instacart’s support, more than 75 California retailers across 3,500 stores are now online, offering delivery and pickup services that meet the growing needs of their customers,” said Ron Fong, California Grocers Association president and CEO. “What Instacart is bringing to the state of California and the rest of the U.S. is a growth runway for brick-and-mortar grocers that deserve the opportunity to continue to serve their local communities for many generations to come.”

“Today in the U.S., grocery is almost a $1 trillion industry—but it’s only now going through its first big wave of tech innovation. Change in a business sector often comes at the detriment of incumbents, and we’ve seen this play out again and again across industries. But it doesn’t have to be that way. Since day one, our goal at Instacart has been to lift up our brick-and-mortar grocery partners and give retailers of all sizes an edge in an increasingly competitive industry,” said Nilam Ganenthiran, president of Instacart. “While we’ve long seen in our own internal data that Instacart can incrementally boost retail partner sales between 50 percent to 80 percent, this study shows that when Instacart enters a market the tides turn and ‘The Instacart Effect’ drives meaningful job creation and increased revenue for the grocery industry.”

The retail grocery industry represents 17 percent of retail employment and 13 percent of retail sales. The study highlights the increased competition facing grocers, which has led to significant economic pressure on the industry. More grocery retailers are turning to delivery solutions like Instacart to compete—and this data provides statistical evidence that the partnerships are helping with retailers’ overall growth.

Instacart today partners with more than 350 national, regional and local retailers to offer delivery from more than 25,000 stores across more than 5,500 cities in the U.S. and Canada. Instacart delivery is currently available to more than 85 percent of households in the U.S. and more than 70 percent of households in Canada.