Cumberland Farms and Costco are Americans’ favorite fueling stations, according to a new study by Market Force Information, a customer experience management company.

More than 11,500 consumers participated in the annual study, which ranks gas stations in two categories—traditional gas stations and convenience stores; and grocery stores and big-box retailers with fuel pumps. The study also reveals trends in food purchases, customer loyalty and technology.

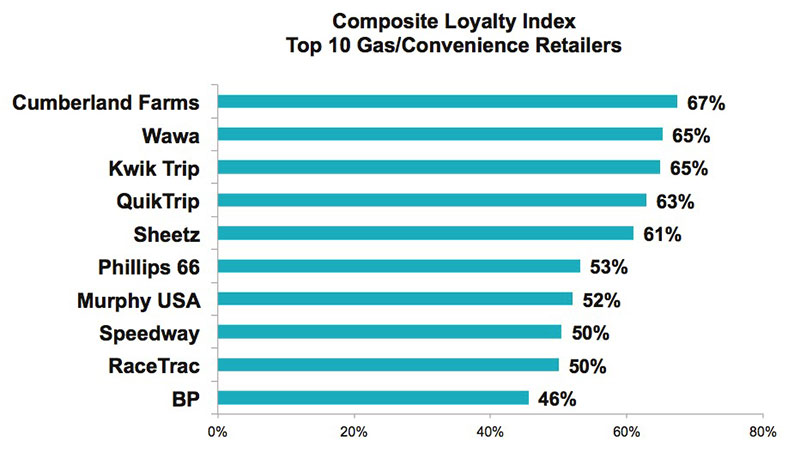

Cumberland Farms moved up one spot this year to rank number one out of the gas stations and convenience store brands studied. The retailer edged out Wawa and Kwik Trip, which tied for second. Last year’s leader, QuikTrip, fell to third place, while Sheetz ranked fourth and Phillips 66 ranked fifth.

Cumberland Farms operates 600 convenience stores and gas stations on the East Coast. The retailer offers a number of fresh food items, as well as its own private label brand of snacks and candy items. The study also found Cumberland Farms’ customers are also some of the most loyal customers. Cumberland Farms tied with Kwik Trip as a brand where motorists fuel almost exclusively when given a choice.

The top three gas/convenience chains on the Composite Loyalty Index in each major U.S. region are:

- West: Shell, Chevron, 76

- Midwest: Kwik Trip, QuikTrip, Speedway

- South: Wawa, QuikTrip, RaceTrac

- Northeast: Cumberland Farms, Wawa, Speedway

Market Force also evaluated how well fuel retailers deliver on a spectrum of customer experience attributes. Murphy led in fuel price for the third straight year, followed by Cumberland Farms and RaceTrac. Phillips 66 ranked highest for fuel quality. QuikTrip was tops in many of the fueling station and in-store categories, such as location safety, appearance and speed of service, and KwikTrip was found to have the friendliest cashiers and best merchandise selection. On the flipside, Arco scored low on all measures except fuel price.

“Even though price tends to drive where people fill up, there are a number of other important areas where gas and convenience store retailers can stand out,” said Brad Christian, chief customer officer for Market Force. “For instance, it’s fully within their control to ensure each of their sites is well maintained and cleaning supplies are available at the pump. We have found in our modeling work that these and other customer experience attributes can generate as much as a twofold difference in the number of gallons an individual site can sell.”

Convenience stores continue to offer healthy, fresh and made-to-order food items in an attempt to sell customers lunch, not just gas. In fact, of the 21 percent who grabbed a fresh food item during their last visit, 35 percent bought a sandwich, 20 percent bought a hot dog and 19 percent opted for pizza. Casey’s General Store was most popular for fresh food purchases, although Wawa had the highest fresh food satisfaction scores.

In the grocery and big-box category, Costco took the top spot for the second straight year. With a 71 percent score, it ranked significantly higher than Sam’s Club and BJ’s Wholesale Club, which tied for second with 61 percent each. Kroger was third, Walmart was fourth and Safeway ranked a distant fifth after its score dropped 13 percent vs. last year.

Consumers often frequent big-box stores and grocers in the hunt for low gas prices, which is an area where Costco ranked first and BJ’s second. Costco also was found to have the best fuel quality, appearance and pumping speeds. Motorists find it easiest to get in and out of Sam’s Club’s and Kroger’s fueling areas.

Fuel app adoption up

Gas and convenience store mobile app adoption shows no signs of slowing down. Twenty percent said they have used one; that’s double the 10 percent who reported doing so in 2016. GasBuddy, which allows motorists to search for gas prices, is still the most popular app. But this year, slightly more people reported that they are using apps to locate gas stations rather than just to compare prices.

When it comes to paying for their fuel, most motorists are swiping their cards or inserting them into chip readers; 10 percent use cash; and 1 percent make mobile payments. Market Force also found 30 percent are worried about security when paying with a method other than cash and, of those, 89 percent are concerned about card skimming devices, followed by the lack of a chip reader.

The survey was conducted online in March 2018 across the U.S. The pool of 11,514 respondents represented a cross-section of the four U.S. census regions. Fifty-two percent reported household incomes of more than $50,000 a year. Respondents’ ages ranged from 18 to 65-plus. Approximately 70 percent were women and 29 percent were men.