First of all, brick-and-mortar stores are “never, ever going away.” But what they need to become may make some people uncomfortable.

That is according to Michael Rogosa, global research director at Planet Retail RNG, who spoke to ROFDA members about the long-term future of retail during the group’s spring conference.

He said that as brick-and-mortar and digital components fuse, physical space will be devoted to “wants,” while e-commerce will be used for need-based products.

“The biggest change that is going to happen is that 15, 20 years from now, (shopping at) stores will be a leisure activity,” Rogosa said. “Because we like to be around people, and we like to engage in shopping in a physical manner. But it’s going to be very different than what it looks like right now because you’ll have some of that e-commerce benefit layered on top of it.”

It is no surprise that shoppers are driving these changes. They are pressuring retailers to adopt initiatives they have become accustomed to online, such as auto-replenishment of center store items. Rogosa asked why a shopper standing in the center store of a supermarket can’t just hit a button or speak into a device and say when and where he or she wants a product.

Shoppers also want physical retailers to provide information and recommendations like they find online.

“Shoppers now have the tools to enable them to get this in other places of their lives so they’re now requesting it and almost demanding it from retail as well,” Rogosa said. “If I can find any information about anything I want just by going to Google, then I should be able to find any information about your products as I’m standing in a grocery store. I should be able to have full transparency of where it came from, full traceability, how old it is, how fast it got from the farm to the actual store.”

Mobile and voice

Technology now is centering around mobile and voice. Shoppers are not using their mobile devices in stores the way some retailers had hoped. But Rogosa said shoppers will use them for checkout as that technology is refined, so for now mobile is here to stay.

“But it’s going to get skipped over a little bit in terms of ordering and in terms of auto-replenishment and then, especially, what’s going to happen to center-store items,” he said. “That’s going to flip to almost immediately becoming a voice-activated platform. And if you think that mobile or e-commerce is hard…imagine a voice environment where you don’t even have a digital page to show them alternatives.”

Retailers should think about how to optimize the shopping experience through mobile technology and voice technology via devices like Google Home or Amazon’s Alexa.

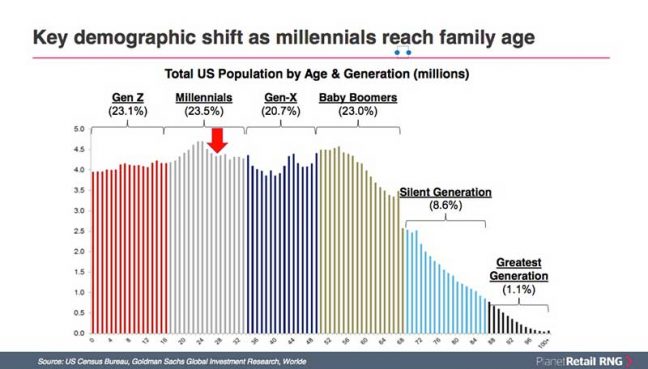

Millennials will drive much of that. They now are moving into their prime consumption years—marrying, buying homes, having children—and pushing the shift to digital in grocery.

The growth rate of e-commerce had flattened out in recent years to about 14 percent. Rogosa said his firm expects it to jump to 17 to 20 percent growth over the next few years as Millennials engage with categories they’ve never shopped before.

They also have different priorities than previous generations. Rogosa pointed to the popularity of “tiny” homes as an example. People, especially younger generations, also are more comfortable sharing so they aren’t spending their money on automobiles and other big-ticket items. The good news is that leaves more money to spend on groceries, including “luxury” foods.

“What we used to spend money on is not what we’re spending our money on anymore, so it opens up opportunities for stores to capture more of that different spend,” Rogosa said.

He compared it to how movie theaters used to charge $12 for a ticket but now, with premium seating and a nice meal, they can ask patrons to pay $45 or more.

“What is the premiumization that we can bring into our stores that helps us capture an additional focus on this spend that they actually have available?” he said.

Stores in the future will offer a curated “discovery” and differentiated environment, enticing shoppers to go the brick-and-mortar route for the “treasure hunt.”

Brick-and-mortar still relevant

Independent grocers who are concerned about e-commerce and digital retail should take heart. Grocery now represents about 2 percent of all food and beverage sold online. Within five years, it has the potential to be between 10 and 12 percent of online food and beverage online sales, though Rogosa suggested 6 to 7 percent is more realistic. That means as much as 94 percent of grocery shopping still will be done in physical stores.

Only a sliver of the future of grocery retail will be home delivery. It will make sense only in dense urban areas where it is profitable.

There is great potential for private label growth. The U.S. is in its infancy in this regard compared to retailers in other parts of the world, he said. Private brands have become exclusives and “a beloved part of why shoppers are visiting these locations,” Rogosa said.

Execution at the store level is and will continue to be critical. Out-of-stocks are the No. 1 issue, even in an online environment.

No retailer is comfortable with their position in the grocery space, Rogosa said. There now are more tests and pilots taking place in grocery stores than in any other retail environment.

“Eventually, we’re going to get to a point where e-commerce and store-based environments are not going to be fighting each other,” he said. “It will even out and the winners will be those companies that have been able to best incorporate the convenience and the assortment and the endless information of a digital world with the actual value proposition of going somewhere physically.”

Keep reading:

Conference Speaker: Trends Behind ‘Retailmaggedon’ Aren’t Going Anywhere

Wegmans Tops Survey As America’s Favorite Grocery Store For Third Straight Year

Acosta: Mix Of National, Private Label Brands Key To Retailer Success